This article shares interesting details about Investing in Stock, Steps for stock Investing, Advantages of stock Investing, Risk management, long term investing, stockbrokers, diversification for investing beginners.

Table of Contents

- What are stocks?

- Why is stock investing an interesting and valuable topic?

- Advantages of Stock Investing

- Disadvantages of Stock Investing

- What are Blue chip stocks?

- What are penny stocks ?

- What is Diversification of Stock portfolio?

- What are the Risk in Stock investing and actions to avoid ?

- How to pick good stocks for Investing ?

- Best way to Identify stock

- How to Buy or sell a stock?

- FAQs

What are stocks?

In simple terms, Stocks are basically the equity or ownership share of the company or Corporation. It is a security that entitles the stockholder to a fraction of company’s assets or earnings. Let us understand by example – If a company has 1000 shares and you buy 10 shares. Then it makes you 1% owner in that company.

Why is stock investing an interesting and valuable topic?

Advantages or benefits of stock investing makes it an interesting and valuable topic. But it also has some disadvantages which need to be considered or analyzed before taking any decision of stock investing.

| Advantages | Disadvantages |

| High Long term returns | Requires analysis and research |

| Liquidity | Taxes on short term stock sales |

| Passive income from dividends | Profit is always subjected to market risk and company performance in future |

| Investments can be done with less fund | Struggle with Emotion and Fear |

| Protection against inflation |

Advantages of Stock Investing

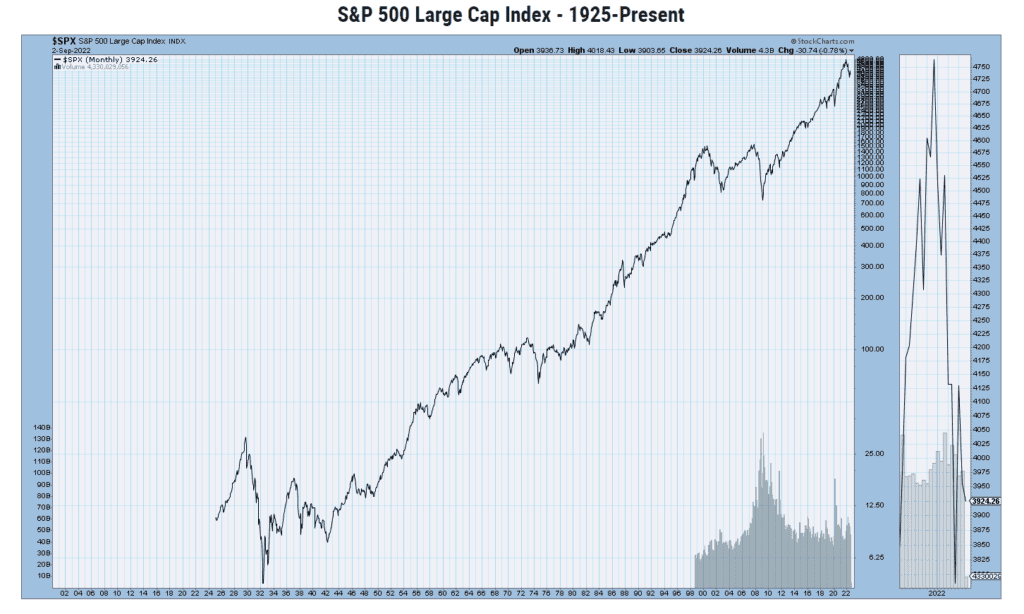

1. High long term returns

If you look at stock market history, in long term equity investment has given better returns than bonds, bank savings, or any other debt funds. There are short term market fluctuations but in long run it comes to an average growth line. Below chart demonstrates over years how the stock market has given high returns if invested in good stable growth companies.

2. Liquidity

Liquidity means you can easily sell stocks and get money if you need in an emergency. It has lesser transaction cost and needs less time. The drawback to this benefit is you may incur losses if you decide to sell when the market is down or the company is not performing during that period and the stock prices are below your purchase price.

3. Passive income

Stock investing can be a better source of passive Income if you decide to invest in companies which give good dividends. This gives an opportunity to earn a small amount back in your bank account passively without actually working for it. Here your invested money works for you even when you are sleeping

4. Investment can be done using less funds

Stock investing provides a better option even for a small investor. An Investor can buy only one stock as per fund availability. In recent years a concept of Fractional shares has been introduced. A fractional share is a portion of a share than one full share. Fractional share cannot be bought or sold on the stock market but it can be done through a broker or online trading platforms.

5. Protection against inflation

Inflation has always grown over years and it has a high impact on returns similar to taxes. if you see historically, stock investing has given higher returns beating inflation. This in turn reduces the overall impact on returns in long term

Disadvantages of Stock Investing

1. Requires research and analysis

This is really a time consuming effort, plus it needs finance knowledge to understand the company’s performance by reading annual reports or balance sheets. Follow finance news and merger acquisition which can impact your investment.

2. Taxes on short term stock sales

If the stock is sold in a shorter term it will incur Capital Gain tax only if Profit is made.

3. Market Risk

Profit is always subjected to market risk and company performance in future, in long run due to company performance or market correction stock prices drops which takes the invested fund at risk. Risk must be a Calculated Risk and if the risk appetite is very less then investing in safer options like bonds etc. is always recommended.

4. Emotional struggle

Market up and down is about to happen in the long run. It is very important for an investor to be emotionally stable and don’t take decisions in panic to avoid any losses.

What are Blue chip stocks?

Blue chip company stocks are more stable company stock, Very High Capitalization, Financially and Growth reliable stock over and over years. It has constant growth over years which make them a good stock investment for long term. Few Examples of Blue chip Companies can be Apple, Amazon, Berkshire Hathaway.

What are penny stocks ?

Penny company stocks are high risk securities, they have very low capitalization and trades for less than $ 5 Value. It cannot be a good option for long term investment as it can be risky and high potential for loss. These are traded via Over the Counter (OTC) transactions. Mostly this instrument is used by traders for intraday trading.

What is Diversification of Stock portfolio?

A definition of Diversification is to Diversify your investments and properly allocate your funds. This will give more reward and balance your risk.

This diversification totally depends on your age, risk appetite, time when you will require money. At younger age your risk appetite may be more than at a later age when you have more liabilities and cannot take more risk as recovery may get delayed. It is very much important to understand your risk profile and what type of investors you are – Aggressive or Conservative.

It is said you should not have all eggs in one basket. Diversification reduces the risk of breaking eggs due to exposure in single stock basket, also it will impact investor opportunity to get more returns and have better volatility.

What are the Risk in Stock investing and actions to avoid ?

Recession Risk

Historically Stock market has up and down but during recession this drop is hugh, which can destroy your investment value. Example Year 2000-01 Dotcom bubble, 2008 Recession, Year 2020 Covid Pandemic recession. Hence Investing in good company stock which has an ability to come back with strong fundamentals and business value and being patient and avoid emotional distress is the effective method to avoid this risk as an investor. Infact Top investor see this recession as an buying opportunity which makes their portfolio stronger as the market rise up.

Inflation risk

Inflation % is a growing number which impact to the returns you earn from stock investing. It is important to invest in stock which has an ability to give returns which can beat inflation. Identification and diversifying your stock portfolio is key to avoid this type of risk.

How to pick good stocks for Investing ?

There are few questions to be asked yourself before analyzing or deciding on any stock.

- What is your goal – Every Investor have a different goal. Example – Someone may think for Wealth creation and having an income for retirement, some Investor may think to derive profit from a company during growth years. So understanding your goal is crucial.

- Time horizon you looking to be invested in – This totally depends on investors need for fund at different stages of life

- Investor’s Interest – If you think to do stock pick on your own instead of help from a professional. The area of interest will be very helpful. A person who is a pharmacist can easily understand the Pharma company plan and strategy of new drug development and patent, A real estate guy can have a better understanding with Company’s investing in or building construction projects. This interest helps the investor in doing initial Analysis.

Best way to Identify stock

- Look around you, see the products and services you regularly use or it is in use around you from a long time. Example: Phone, Internet Connection, Social media company, FMCG products, Pharma. This can be the starting step to filter few in your list.

- While doing this always keep in mind diversification, which is required to reduce risk and volatility in your investments

- Fundamental Analysis: There are two type of Fundamental analysis – Qualitative and Quantitative. Qualitative analysis means how is the company brand, company ethics, Company history etc., whereas Quantitative Analysis is about metrics and numbers like Intrinsic Value of a particular stock to understand if it is under or over valued at the time of purchase, Earning per share, balance sheet and earning report number are used to perform Quantitative analysis

- Technical Analysis: This analysis includes Price analysis, volume Analysis, Trend and pattern study using indicators like Moving average, Relative strength Index (RSI), Fibonacci levels etc. These indicators help to support buy and sell decision at a particular time.

How to Buy or sell a stock?

1. Select a broker based on your preference on trading platform interface, technical analysis indicators availability, charting interface, Learning and new feeds recommendation, Transaction cost like fees, Support team etc. there are many available, few are listed

2. Once you have a trading account, you can analyze the stock you are interested and put a order either to buy or sell the stock.

FAQs

1. How many stocks can be part of my portfolio ?

Most of the Finance and stock investing expert says, 10-30 can be a good number to have in your portfolio. The important part is it must be manageable and diversified

2. Any suggestion of Books for Stock Market learning

Intelligent Investor – by Benjamin Graham can be the best for reading to invest in stocks

3. I feel stock investing is risky, unable to identify best stock, what can i do?

Index fund investing is an option for this, this reduce your risk of investing in a single stock. Index fund invest in top companies list on the Index and it is adjusted as per the company position in Index. This can be bought via same broker trading platform

Content and information in this Article is for information and knowledge purpose. Please make your own due diligence before taking any financial decisions.